- The Index is split into three processes - Machining, Fabrication, and Others.

- 2022’s data for Quarter 4 is collected from 210 companies and 318 projects.

- Quarter 4's Index fell by 34% against the preceding quarter; some of this fall could be attributed to a seasonal downturn.

- Both the Machining and Fabrication reported large falls against quarter 3,

This was certainly not a good quarter for the subcontracting market. It has become very obvious how purchasing patterns are affected by political turmoil and that this economic uncertainty has had a direct impact on manufacturing decisions.

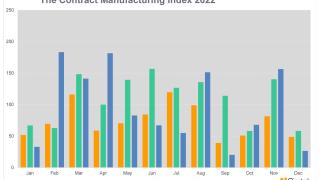

The CMI for the fourth quarter of 2022 was 73 compared to 102 for the previous quarter which is a drop of 28% and 110 for the final quarter of 2021.

Looking at 2022 as a whole, the year started slowly before showing healthy growth from May to August before tailing off in September. The average CMI for 2022 was 91, which was just 6% down on the average for 2021 and 3% up on the average for 2020.

CMI Machining quarter 4 2022

- 58% of the fourth quarter's projects were for machining processes.

- the machining index fell 30% compared with the previous quarter

- it fell 13% compared to quarter 4 2021

- The trend for the year was slow decline throughout the year

Fabrication CMI quarter 4 2022

- 32% of the fourth quarter's projects were for fabrication processes.

- the fabrication index fell 32% compared with the previous quarter

- it fell 40% compared to quarter 4 2021

- fabrication held relatively steady across the year

CMI Industries quarter 4 2022

The strongest industry sectors in Q4 were:

- Industrial Machinery, which actually dropped back to Q2 levels after a 70% spike in Q3

- Food and Beverage, which showed a 90% increase on Q3

- Consumer Products, which almost doubled.

The biggest losers were Construction which dropped by 80% and Oil/Chemical/Energy, which dropped by 73% in value.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the second quarter of 2022. In order to shed more light on the emerging trends, we have also broken this down by process and industry.