- The Index is split into three processes - Machining, Fabrication, and Others.

- 2020’s data for Quarter 1 is collected from 188 companies and 322 projects.

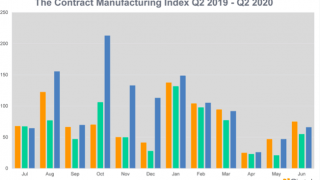

- Quarter 2 was a very challenging time for the UK's manufacturing industry due to the Covid-19 pandemic.

- However, June's results reflected some recovery against April and May

It comes as no surprise that the second quarter's Contract Manufacturing Index showed a significant reduction in activity. As the UK weathered a national lockdown during April and May due to the Covid-19 pandemic, many industries came to a complete standstill, whilst others substantially reduced their manufacturing output. However, as the lockdown began to lift, the UK's manufacturing industry ramped up its activity, meaning that June's results show a lot more promise than the previous two months.

Machining and fabrication were largely affected by the lockdown and there was a significant fall in their corresponding indexes; however, the Others Index - which accounts for an array of specialist processes - reported only a 3% drop from Quarter 1's results during the second quarter.

The industry had braced for a challenging quarter and therefore, the latest findings will not be unexpected. Indeed, June's results are encouraging, as they show that the industry is headed in the right direction. We hope that by Quarter 3, the Contract Manufacturing Index will be well on its way to recuperating from the effects of the pandemic, although there is still some degree of uncertainty surrounding the UK manufacturing industry's immediate future.

Machining:

Despite displaying unprecedented growth of 89% during Quarter 1, the Machining Index has found itself the most affected by the national lockdown and shrank by 68% during Quarter 2. However, it accounted for a larger share of projects during Quarter 2 (46%) than Quarter 1 (43%) due to the sizeable falls within the Fabrication Index's output.

- 46% of the second quarter’s projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £6,659,800, compared to a value of £20,512,633 in Quarter 1 2020.

- This index was the most affected by the national lockdown and saw the most prominent drop in activity. However, during Quarter 1 the Machining Index grew by 89%, meaning that the pandemic has hampered its newfound growth after consistent falls throughout 2019.

Fabrication:

The Fabrication Index was also significantly impacted by the national lockdown; however, it was not affected as much as the Machining Index. The Fabrication Index saw a 59% decrease from Quarter 1 to Quarter 2 and accounted for only 34% of the total projects during this period. This is in spite of a positive start to the year, during which time the Fabrication Index grew by 87%.

- 34% of the second quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £8,792,850, compared to £21,758,807 during Quarter 1.

- Although not hit as hard as the Machining Index, the Fabrication Index saw a substantial drop as a result of the national lockdown, This index also saw a strong start to the year which was subsequently curtailed by the pandemic; however, as with the other indexes, June's output was vastly improved compared to April and May.

Others:

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category makes up 20% of the projects generated within the second quarter and is therefore more difficult to monitor. The Others Index seems to have been the least affected by the national lockdown and shrank by only 3% during Quarter 2. Unlike its fabrication and machining counterparts, the Others Index fell during Quarter 1, so it is somewhat surprising that this index experienced a smoother journey through the national lockdown than the remaining indexes.

- 20% of the second quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £5,523,133, compared to a value of £5,734,020 in Quarter 1, 2020.

- The Others Index was the least affected by the Covid-19 pandemic and shrank by only 3% during Quarter 2. It also accounted for a larger share of the total number of projects during this period than it did during Quarter 1 (12%).

Industry:

- The Defence/Military sector was the forerunner of Quarter 2's outsourcing efforts and accounted for 18% of the total spend during this period.

- The Construction industry was not far behind and contributed 15% of the total outsourcing spend during Quarter 2.

- The Electronics sector matched the Construction industry's efforts and also accounted for 15% of Quarter 2's outsourcing levels, putting it in joint second place.

- The Industrial Machinery sector's outsourcing fell just shy of Electronics and Construction, with a 14% share during Quarter 2.

Having just scraped into Quarter 1's results in eighth place, the Defence/Military industry was the leader of UK outsourcing during the second quarter of the year. This sector accounted for 18% of total outsourcing efforts during this period compared to just 5% during Quarter 1, indicating a surge of activity in this sector contrasted with reduced outsourcing levels in others. Meanwhile, the Construction and Electronics industries each contributed 15% of the total outsourcing spend from April to June, putting both of these sectors in tied second place. Whilst Construction also saw a busy start to the year and placed second for the second consecutive quarter, Electronics was much quieter from January to March, finishing the first quarter in sixth place. The Industrial Machinery sector also retained its place from the first quarter into the second - this industry's outsourcing levels fell just shy of that of Construction and Electronics, with 14% of the total spend.

Elsewhere, the Furniture sector made its first appearance since the third quarter of 2019 and accounted for 13% of Quarter 1's outsourcing activity. Niche industries that fall into the 'Others' category were also fairly buoyant during the second quarter - indeed, this category was the fifth largest contributor from April to June.

Newcomers were also seen at the bottom of the table in comparison to Quarter 1's results. The Agriculture industry - which was absent from 2019's results entirely - placed sixth during Quarter 2 with 9% of the total spend. Meanwhile, the Pump & Valve sector, which has been absent from the top industries since 2016, has re-emerged into eighth place, having contributed 6% of the total outsourcing spend from April to June.

About the Contract Manufacturing Index:

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the second quarter of 2020. In order to shed more light on the emerging trends, we have also broken this down by process and industry.