Market up 8% in Q1 on previous quarter and up by 56% on previous year

The value of the UK contract and subcontract market rose by nearly 8% in the first quarter of 2016 compared to the final quarter of 2015, according to the latest Qimtek Contract Manufacturing Index (CMI) figures.

The index for the first quarter of 2016 was 155, compared to 144 in the final quarter of 2015. Compared to the value of the market 12 months ago the change has been dramatic, with the market growing by a massive 56% from a low base of just 92.

The base line figure of 100 represents the average value of the subcontracting market during 2014.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3bn and a supplier base of over 7,000 companies with a verified turnover in excess of £25bn.

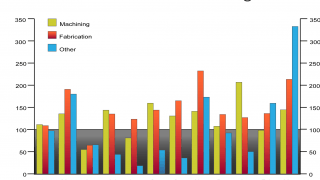

Machining was up by 19% on the final quarter of 2015 and accounted for 54.5% of the value of the contract manufacturing market.

Within these overall figures there were some dramatic fluctuations, with machining rising by 92% from December to January but then dropping by more than half before starting to recover in March.

Fabrication accounted for 39% of the value of the market and fell by 11% compared to the final quarter of 2015, but was showing strong signs of recovery in March.

Other processes, including electronics and plastic moulding, more than doubled and represented just under 7% of the total.

Commenting on the latest Contract Manufacturing Index figures, Karl Wigart, owner of Qimtek, said: “There is no doubt that the value of the subcontract manufacturing market is on an upward trend, even if this is not reflected in manufacturing generally. Within that we have seen some noteworthy fluctuations.

“February was an unusual month for us as we had a low value on machining which usually has the higher spend. Looking a bit deeper into the data, you can see the volume was the same but the companies doing the buying had a smaller spend than usual. The large companies stayed away.

“March looks better but, machining is lower again due to the large outsourcing companies not seeking to place as much business. However, fabrication and other processes have picked up so the total value is up again.”