Every quarter, Qimtek publishes the Contract Manufacturing Index (CMI) to highlight trends and give insight into the buoyancy of the subcontract manufacturing market.

We do this by monitoring the purchasing budget of companies who are looking to outsource manufacturing within any given month; this reflects a sample of over 4,500 companies with a combined purchasing spend of over £5.8billion, with a verified turnover in excess of £26billion. The information is extracted from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers - it is therefore exclusive to Qimtek, but reflects the health of the overall market.

The following is an overview of 2020’s data as a whole, showing how the individual indexes performed over the course of the year and which industries outsourced the most.

Key Points:

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2020’s data is collected from 930 companies and 1,503 subcontract engineering projects.

- The Index has dropped by 15% from 2019 to 2020.

- The Machining Index is down 9% on 2019’s data.

- The Fabrication Index has decreased by 22% this year.

- The ‘Others’ Index - accounting for niche processes such as toolmaking, casting, moulding and finishing - has more or less maintained the same value across 2019 and 2020.

Commentary:

After a difficult year in 2019, the industry showed strong signs of recovery during the first quarter of 2020. The Contract Manufacturing Index reported growth during this period for the first time in twelve months, increasing by a staggering 69% from the previous quarter. This result puts January to March 8% above the 2019 average overall, although there was a slight decline month on month which corresponds with the worsening health crisis and the rise of COVID-19.

Needless to say, national lockdown had a devastating effect on the overall performance of the UK subcontract manufacturing industry.

The UK went into its first national lockdown in March, remaining there throughout the second quarter of the year. Needless to say, this had a devastating effect on the overall performance of the UK subcontract manufacturing industry, with all three Indexes plummeting to new lows. With that being said, the industry began to show signs of life during June as restrictions started to lift, resulting in a unanimous rise in outsourcing levels across all processes.

The third quarter saw 2020's subcontract purchasing levels peak as the industry came out of hibernation. The Contract Manufacturing Index reported its most successful quarter since the first quarter of 2019, with all three indexes increasing dramatically during this time. The Others Index in particular enjoyed a boom during July, with the Machining Index also undergoing a significant rise. The Fabrication Index lagged behind somewhat by comparison, though it still saw an increased output in relation to the previous quarter.

Whilst Quarter 4 saw a tail-off in activity, this is not unusual in the context of previous years. Historically, the Contract Manufacturing Index does report a seasonal lull from October to December, which means that the second national lockdown in November may not have been entirely to blame. Indeed, the outsourcing levels during this period were far higher than the first lockdown in Quarter 2 and given the mounting uncertainty surrounding post-Brexit trade deals, the industry still managed to deliver a consistent performance. November was especially buoyant, which seems to contradict the notion that national restrictions impeded activity for a second time in 2020.

Trend Overview:

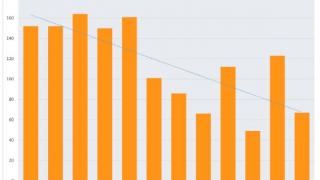

The bar graph above shows the values of each index month to month, with the Machining Index shown in orange, the Fabrication Index shown in green and the Others Index shown in blue.

All three Indexes followed an erratic trajectory over the course of 2020. Despite a positive first quarter (albeit with a month-on-month decline), the national lockdown at the start of the second quarter led to a significant reduction in all activity from April to June. Once the industry started to open up again, there was a surge in outsourcing levels during Quarter 3. This was particularly pronounced within the Others Index, which dwarfed that of machining and fabrication from July to September - a very rare occurrence in the history of the Index overall.

Quarter 4 brought with it another national lockdown and once again, we see a reduction in activity. However, this could be attributed to a seasonal trend, as November had a fairly positive output despite the government restrictions - particularly for the Fabrication Index, which exceeded that of its counterparts before falling back in line during December.

Distribution of Projects:

2020 saw the Machining Index regain - and then exceed - the ground it lost in 2019, with a 56% share of the total projects compared to 43% in 2019. However, this came at a cost for the Fabrication Index which lost significant ground in 2020, with just a 31% share of the project distribution. Overall, this index decreased by 13% from 2019 to 2020.

Meanwhile, the Others Index maintained a consistent hold on project distribution across 2019 and 2020, reflecting 13% of the total projects within each year. This is a sizeable jump from preceding years, with 2017 and 2018 reporting just 7% and 8% respectively.

Share of Outsourcing Values:

2020 reported small changes within the share of outsourcing values, although the ratios have remained the same from 2019 into 2020. The value of the overall data - and therefore, the total outsourcing value of all of our buying organisations - grew by 7%, raising it from £5billion in 2019 to £5.8billion in 2020.

Top Industries:

The strongest sector according to output in 2020 proved to be the Construction industry, which accounted for 22% of all subcontract purchasing throughout the year. Construction was one of the most consistent performers during this period; while many other industries moved up and down the board, fluctuating wildly in their output, Construction placed in the top three from Quarters 1 to 3, before eventually falling to seventh in Quarter 4. It's also worth noting that 2020 is the second year that Construction has maintained a strong, consistent level of subcontract purchasing, having finished second overall in 2019.

The Construction industry traded places with last year's best-performing sector - Oil/Chemical/Energy. Despite a strong start and placing first during Quarter 1, this industry only made one more appearance during 2020, finishing eighth in Quarter 3. Meanwhile, the Industrial Machinery sector ascended from sixth place in 2019 to third in 2020, accounting for 17% of all projects generated compared to just 4% the previous year. This industry, like Construction, sailed steadily through 2020, never placing less than fourth and finishing the year as the top outsourcer from October to December. However, the success of this sector could also be attributed to a decline in activity from the Heavy Vehicles/Construction Equipment industry, which slipped from third into seventh place in 2020.

The Construction industry accounted for 22% of all subcontract purchasing throughout the year.

The two backrunners of 2019's top industries - Electronics and Furniture - increased their subcontract activity during 2020, resulting in mid-level placement of fourth and fifth respectively. Another noteworthy contender was the Food & Beverage sector - despite only placing sixth, this sector actually experienced an increase in outsourcing of 200% from 2019 to 2020, which is more than any other industry during this period.

Meanwhile, the Marine and Automotive sectors were also featured in eighth and ninth place. These industries were absent from 2019's results altogether, showing an increase in output, though neither were consistently seen in quarterly reports throughout the year. Automotive disappeared from the results after Quarter 1, where it placed fourth, whilst Marine was only present during Quarter 3, in third position.

Notably - and perhaps surprisingly given the current health climate, the Medical/Scientific industry disappeared from 2020's results, having been the fourth largest contributor towards subcontract spending during 2019. The same is also true of the Defence/Military sector, which placed fifth overall last year, but was absent from 2020's results.

Conclusion:

2020 was a year like no other, so it's unsurprising that the Contract Manufacturing Index shrank during this time. Given that the UK spent three months - or 25% of the year - in full lockdown and compounded by the trade uncertainties surrounding Brexit, perhaps the greatest surprise is that the Index only fell by 15% as a result.

With 2019's Index also showing a downwards trajectory, the recovery which materialised at the start of the year could not possibly be sustained through the trials of Quarter 2. However, the remainder of the year showed some promise; Quarter 3's surge in outsourcing gave the industry a boost it desperately needed, whilst Quarter 4 - though significantly reduced by comparison - was fairly buoyant considering the UK had entered its second national lockdown.

Given that the UK spent 25% of the year in full lockdown, perhaps the greatest surprise is that the Index only fell by 15%

In terms of industry, Construction, Oil/Chemical/Energy and Industrial Machinery were the largest contributors towards outsourcing during 2020, though it has to be noted that there were a number of inconsistencies amongst many sectors from quarter to quarter. Whilst the subcontract purchasing levels amongst some industries stayed stable throughout the year, others (such as Marine and Automotive) made high-level cameo appearances, before disappearing altogether.

Back in September, it was reported by many of our buyers that they would shortly be sourcing for new projects, although many of these failed to materialise. With uncertainties surrounding material and transport shortages presiding over much of the industry, a hesitancy to commit to new ventures became evident as the year went on. With some light being shed on trade deals post-Brexit and the COVID-19 vaccination currently being rolled out, we are hopeful that the industry will begin to recuperate in 2021. However, with the UK now in its third national lockdown, we are still unsure as to when in the year this will occur.