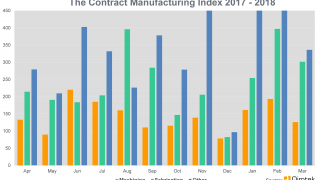

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and the following is a summary of our findings for the first quarter of 2018. In order to shed more light on the emerging trends, we have also broken this down by process and industry.

Key points:

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2018’s data for quarter 1 is collected from 360 companies and 567 projects.

- Quarter 1’s results are up 42% from 2017’s fourth quarter and 32% on the comparable quarter for 2017.

Machining

The final quarter of 2017 was not a positive one for the machining index, reflecting a 27% fall; however, the latest results show a rise of 31%, meaning that the index has more than recovered from this temporary dip. Furthermore, 2018’s quarter 1 index has grown by 14% in comparison to the corresponding quarter in 2017.

- 53% of the first quarter’s projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £24,856,207.

- Quarter 1’s machining index grew by 31% in comparison to the preceding quarter - a rise of 14% in relation to the first quarter of 2017.

Fabrication

Showing an impressive 54% rise from the preceding quarter, 2018’s Q1 results are positive for the fabrication industry as a whole. The fabrication index fell by 50% during 2017’s final quarter, meaning that recuperation has been achieved within 2018 to date. The latest figures also reveal a 40% rise in relation to the comparable quarter for 2017, with 35% of the total projects generated accounting for fabrication processes.

- 35% of the first quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £33,358,593.

- The fabrication index grew by 54% in comparison to 2017’s quarter 4, with the latest results also showing a 40% rise against 2017’s quarter 1 index.

Others

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category only makes up 12% of the projects from the first quarter and is therefore more difficult to monitor. However, the results show that the index for this category has increased by 25% on the last quarter and by a massive 50% in relation to Q1 2017.

- 12% of the fourth quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £7,201,150.

- The index for these processes grew by 25% compared to the fourth quarter of 2017.

Industry

- Having undergone a massive surge during quarter 1, heavy vehicles/construction equipment has risen from fourth to first place, representing 23% of the market.

- The automotive industry has also performed extremely well within the first quarter, climbing from fifth place into second and holding 21% of the index.

- With a 14% standing, industrial machinery is in third position, having featured in second place during the preceding quarter.

Having remained somewhat static from Q3 to Q4 2017, the first quarter of 2018 has brought with it a shake-up to the top industries represented. The heavy vehicles/construction equipment industry and the electronics sector have switched places, with the former accelerating into the top spot and the latter sliding down into fourth position. The automotive industry has also performed well from January to March, resulting in an astounding rise from fifth place into second, with 21% of all projects generated in quarter 1 accounting for automotive applications. Perhaps unsurprisingly, the industrial machinery sector has maintained its position within the top industries, albeit as the third best represented within the results, falling from second place.

The first quarter of the year has also seen the re-emergence of a number of previously unrepresented industries. The food & beverage industry secured its position in fifth place with 12% of the projects generated, whilst medical & scientific fell shortly behind this with a 9% standing.

The most dramatic fall of quarter 1 comes from the construction industry. Having placed third during the final three months of 2017, it has now sunk to eighth position, narrowly escaping erasure from the top industries altogether.

Conclusion

After experiencing a slight lull within the final quarter of 2017, the latest results show that the index is now following an upwards trajectory across the board. Whilst all three indexes have seen growth over the past three months, the main drivers are both the fabrication and the ‘others’ index (accounting for processes such as casting, toolmaking, finishing, plastics & rubber), with the machining index reporting less pronounced growth than its counterparts.

The top industries have undergone a reshuffling within the past three months, although the top three industries - comprised of heavy vehicles/construction equipment, automotive, and industrial machinery - are all consistent within the context of historic indexes and are somewhat anticipated to perform highly.

The latest figures confirm that the index is at its highest level to date, although it’s important to note that the manufacturing market is slowing down - as reported by the Markit CIPS Purchasing Index, as well as ONS. We have seen both positive and negative outcomes within the market’s current climate; although we continue to generate an abundance of high-value subcontract manufacturing projects, there has also been an unfortunate influx in the number of suppliers closing their doors. This unwelcome side-effect is a largely a result of harsher payment terms being imposed by purchasers, leaving some companies burdened with cash flow issues as they ride out the interim period being shipment and payment.

We are very curious to see the results of the second quarter and remain positive that these will confirm the ongoing strength of the UK manufacturing industry overall.

More about the Contract manufacturing Index.