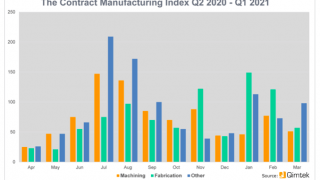

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2021’s data for Quarter 1 is collected from 253 companies and 384 projects.

- Quarter 1 2021's Index shows growth of 25% against the preceding quarter; however, it was 25% smaller than the comparable quarter for 2020.

- Both January and February exhibited substantial activity, although this slowed down towards the end of the quarter.

- However, the average order values within this period were the highest ever recorded. This shows that manufacturing buyers are awarding more work, with less speculative enquiries.

The Contract Manufacturing Index for the first quarter of 2021 has seen marked growth in comparison to the previous quarter overall; however, there has been some disparity amongst the individual indexes themselves. Reporting a 25% increase against the final quarter of 2020, the latest Contract Manufacturing Index depicts a strong start to the year with substantial outsourcing activity during January and February, although it underwent a slower period during March as the quarter came to a close. In addition, the average order value reached record levels during Quarter 1, hinting at an uptake of work awarded, with less speculative enquiries than in previous quarters.

The increased average order value could indicate that the industry is stabilising.

Although the Fabrication Index reported an overwhelmingly positive trajectory, with growth of 132% in comparison to the preceding quarter, the Machining and Others Indexes failed to exceed their respective outsourcing levels from the final quarter of 2020. Both of these indexes reported a decline against the previous quarter, which means that the growth of the Contract Manufacturing Index as a whole can be attributed to an uptake in subcontract fabrication work. In addition, the latest Contract Manufacturing Index shrank by 25% in comparison to the first quarter of 2020, which is perhaps unsurprising considering the events of the past twelve months.

Whilst the first quarter of any year is a traditionally buoyant period for the UK's subcontract manufacturing industry, 2021's efforts were slightly hampered by a third national lockdown, as well as the finalisation of Brexit. With that being said, the increased average order value could indicate that the industry is stabilising as the political ramifications become clearer, meaning that there is less hesitation to commit to business decisions.

As the UK emerges from its third lockdown, we hope that the second quarter of 2021 will see an increase in subcontract manufacturing activity, especially given the recent reshoring efforts in the wake of Brexit and the COVID-19 pandemic.

Machining

Although the Machining Index fell by 6% during the final quarter of 2020, it could be argued that seasonal trends hampered outsourcing efforts during this period. However, no such justification exists for the first quarter of 2021, which usually reports strong activity across all three Indexes. Instead, the Machining Index declined by 22% from January to March, which placed it 43% behind that of the first quarter of 2020.

- 52% of the first quarter’s projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £10,635,447, compared to a value of £14,855,550 in Quarter 4 2020.

- The Machining Index did not experience a positive start to 2021, falling by 22% in Quarter 1. In addition, this Index was 43% smaller than in the comparable quarter for 2020, showing a marked decline in outsourced machining activity over the past 12 months.

Fabrication

The Fabrication Index saw a surge in activity from the final quarter of 2020 into the first quarter of 2021. Overall, this Index experienced remarkable growth of 132% from January to March - far outweighing the performance of the Machining and Others Indexes and making it the only index to increase during this period. Despite its strong positive trajectory, the Fabrication Index still finished 6% behind that of the comparable quarter for 2020, although this decline is far less pronounced than that of its counterparts.

- 31% of the first quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £20,624,453, compared to £8,915,075 during Quarter 4 2020.

- The Fabrication Index exhibited astronomical growth of 132% from the final quarter of 2020 into the first quarter of 2021. In comparison to the first quarter of 2020, this Index is 6% smaller; however the drop is not as dramatic as those experienced by the Machining or Others Index.

Others

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category makes up 17% of the projects generated within the first quarter and is therefore more difficult to monitor. With that being said, this Index experienced a substantial drop of 26% from the final quarter of 2020 into the first quarter of 2021 and a 35% decline in comparison to the first quarter of 2020.

- 17% of the first quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £3,680,053, compared to a value of £5,014,370 in Quarter 4, 2020.

- The Others Index dropped by 26% during the first quarter of 2021 and by 35% in comparison to the first quarter of 2020.

Industry

- For the second quarter in a row, the Industrial Machinery sector has displayed the most subcontract purchasing activity, placing it at the top of the leaderboard with a massive 42% contribution towards the total spend during Quarter 1 2021.

- The Furniture industry has ascended from fifth place during the final quarter of 2020, into second position during the first quarter of 2021. Overall, this sector accounted for 24% of all subcontract purchasing during this period.

- Meanwhile, the Electronics sector conceded its previous position in second place, dropping to third position from January to March 2021 with 12% of the overall spend.

From the final quarter of 2020 into the first quarter of 2021, there wasn't much disparity between the top industries contributing to the total outsourcing spend. The Industrial Machinery sector maintained its position at the top of the leaderboard over both quarters and from January to March 2021, it accounted for an astonishing 42% of all subcontract purchasing activity. The size of the Industrial Machinery sector's contribution overwhelmed that of any other industry, making results further down the table slightly more granular than usual.

From January to March 2021, the Industrial Machinery sector accounted for an astonishing 42% of all subcontract purchasing activity.

Meanwhile, the Furniture sector underwent a steady ascension, finishing in second position this quarter in comparison to fifth during Quarter 4 2020. Contributing 24% of the total spend during the first quarter, this was enough for this sector to overtake the Electronics industry, pushing it from second place into third with a 12% share of the spend.

Elsewhere, the Communication Equipment sector also experienced a surge in activity during Quarter 1. Having previously placed eighth during the final quarter of 2020, this sector finished fourth overall, accounting for 6% of all outsourcing activity from January to March. The same can be said for the Construction industry, which rose from seventh place into fifth, with 5% of the total spend.

Further down the board, the Environmental Technology industry, which failed to place during Quarter 4 2020, emerged in sixth position, whilst 'Other' industries - that is, industries that fall outside of Qimtek's specified sectors - accounted for 4% of the total spend within the first quarter of the year.

In eighth place, the Medical/Scientific industry accounted for 3% of outsourcing efforts from January to March 2021, seeing it fall by four places from the preceding quarter. Meanwhile, the Heavy Vehicles/Construction Equipment sector and the Autosports industry disappeared from Quarter 1's results altogether, having placed third and sixth respectively during the final quarter of 2020.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the first quarter of 2021. In order to shed more light on the emerging trends, we have also broken this down by process and industry.