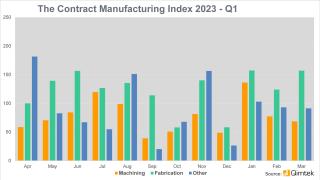

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2023’s data for Quarter 1 is collected from 212 companies and 357 projects.

- Quarter 1's Index increased by by 60% against the preceding quarter.

- All three sub indexes increased against the previous quarter.

January started off by hitting record levels of outsourcing and the over the quarter, the CMI index grew by 60% from previous quarter to 117. Fabrication has the largest increase while Machining had the largest increase of projects for the quarter.

Overall, it was a good quarter with increased activity on number of projects, number of awards, the average award value and the number of quotes buyer are getting per project.

The average quotes per project is up 10% from previous quarter and while the average award values were up 2%.

We know it is not an easy business climate at the moment, but everyone seems to be active and

trying to do something about it.

Machining CMI quarter 1 2023

- 62% of first quarter projects were for machining process

- The buyers of machining process has a total outsourcing value of £18,555,840 and incresea of 51% from previous quarter

The number and values of machining projects were very good in January but dropped down again in February and March. Of all the processes Qimtek does, machining was by far the most active in quarter 1.

Fabrication CMI quarter 1 2023

- up 72% with a outsourcing value of £27,569,067

- 30% of all projects

Big increase in values of Fabrication projects and we can see this in our Industry breakdown as Electronics sector is busy with outsourcing enclosures.

Other processes CMI quarter 1 2023

- 14% of projects

- Increase of 14% with an outsourcing value of £3,719,850

Again, an increase in the Other breakdown which is good news as it means all sections of the manufacturing business is active with new business.

Industries CMI quarter 1 2023

Industrial machinery is topping the chart again with a 52% share of all industries. Food & beverages is second this time as well with Consumer products with 8% is in third place up from 11th place.

Electronics, 9% is 5th with the same percentage of the whole as last quarter. Medical and science is in 6th place with Consumer products in 7th, down from 3rd place last quarter.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the 1st quarter of 2023. In order to shed more light on the emerging trends, we have also broken this down by process and industry.