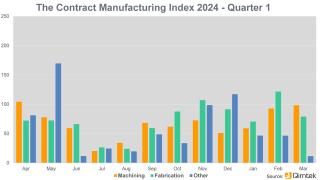

- The Index is split into three processes - Machining, Fabrication, and Others.

- 20243’s data for Quarter 1 is collected from 219 companies and 387 projects.

- Quarter 1's Index increased by 5% against the preceding quarter.

A lot of the projects which we had been told in quarter 4 of 2023 were at last released at the beginning of this year. We saw far more projects than we have ad for years and suppliers have been very busy quoting.

The lead times dropped from an average of 22 days in 2023 down to 18 days in January and February but came back to 21 days in March.

Machining

- 56% of fourth quarter projects were from machining processes.

- The buyers of machining processes has a total outsourcing value of £16,729,687 which about average for the year.

- The index is for machining is up 34% from previous quarter but down 9% on previous year

The biggest winner this quarter and the trend is for continuous growth.

Fabrication

- 32% of fourth quarter projects were from fabrication processes

- The buyers of fabrication processes has a total outsourcing value of £17,041,527 which is slight above the average for last year.

- The index for Fabrication is down 38% on last quarter but pretty close to last years figures, only 5% lower

Although down this quarter, the overall trend is of growth.

Others

- 10% of fourth quarter projects were from other processes

- The buyers of other processes has a total outsourcing value of £1,350,867 which a lot lower then average for last year.

- The index for Others is down 58% on last quarter and 64% down on last year

Other is our smallest sample data and if varies more than Machining and Fabrication but the trend is going down.

Industry

Industrial Machinery is on top again followed by Construction and Electronics. Construction going from 8th to 2nd and Electronics staying third while Food & Beverages dropping from 2nd to fourth.

Lead times

We have now collected data for Lead times for 12 months so I thought I would publish the basic data. I think it is far to early to draw any conclusions as I'm not sure what is seasonal affects on lead times.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the this current quarter. In order to shed more light on the emerging trends, we have also broken this down by process and industry.