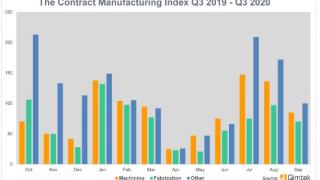

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2020’s data for Quarter 3 is collected from 266 companies and 416 projects.

- The results for Quarter 3 reflects a time where the UK manufacturing industry was recovering from a national lockdown.

- Quarter 3's data is overwhelmingly positive, with a 150% improvement in comparison to the preceding quarter and 43% growth on the comparable quarter in 2019.

The latest Contract Manufacturing Index comes at a time when the UK manufacturing industry is beginning to recover from the national lockdown experienced during the end of the first quarter and throughout most of Quarter 2. Therefore, we were certain that we would start to see some recuperation in the latest results; however, these have more than surpassed our expectations. In fact, 2020's third quarter has been the most buoyant period for the UK manufacturing industry since the first quarter of 2019.

A rise in outsourcing saw the level of activity surge during July and August across all three indexes, followed by a slight decline in September. However, the UK manufacturing industry is itself adapting to a 'new normal', with some of the manufacturing workforce working from home and projects therefore taking longer to complete. Subsequently, the tail-off experienced during the end of the quarter could be only a short-term setback to the overall growth and recovery of UK industry, which seems to have weathered the worst of the storm remarkably well.

We have been informed by several large manufacturing buyers that there are projects in the pipeline which will help to restore the growth seen during July and August; therefore, we hope that September is nothing more than a temporary blip in the Index's trajectory. The results for Quarter 4 will offer much more insight into the aftermath of the lockdown for the UK manufacturing industry at large.

Machining:

Having been hit hard by the effects of the national lockdown during Quarter 2, Quarter 3 reported a positive trajectory for the Machining Index, which grew by 27% from July to September. 2020 has been an erratic year for this index in particular - having started the year with 89% growth in Quarter 1, the second quarter saw it drop by a massive 68%. The latest results hint at recuperation for the machining sector; however, it's important to note a drop in activity during September.

- 46% of the third quarter’s projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £16,245,736, compared to a value of £6,659,800 in Quarter 2 2020.

- Out of all of the indexes, the Machining Index was the most affected by the effects of the national lockdown and shrunk dramatically during Quarter 2. This followed a period of substantial growth during Quarter 1, which reported an increase of 89%.

- However, Quarter 3 saw a recovery of 27% in comparison to Quarter 2.

Fabrication:

The Fabrication Index performed extremely well during Quarter 3, exhibiting its strongest output since the first quarter of 2019. With a total value of £30,265,347, this index saw growth of 66% from July to September, with activity spiking during August. Following the national lockdown, the Fabrication Index fell by 59% during Quarter 2; however, in terms of value alone, this index has consistently been the largest throughout the entirety of 2020.

- 37% of the second quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £30,265,347, compared to £8,792,850 during Quarter 2.

- The Fabrication Index experienced a much more pronounced recovery than that of the Machining Index. It has also consistently been the best-performing index in terms of value throughout the whole of 2020.

- Quarter 3 2020 was the Fabrication Index's strongest period since the first quarter of 2019.

Others:

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category makes up 17% of the projects generated within the third quarter and is therefore more difficult to monitor. However, this index also experienced a positive Quarter 3 and grew by 8%, making it the strongest performance the Others Index has undergone since the second quarter of 2019.

- 17% of the third quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £6,069,870, compared to a value of £5,523,133 in Quarter 2, 2020.

- The Others Index experienced its strongest quarter since the second quarter of 2019 and grew by 8% from July to September.

Industry:

- The Construction industry dominated Quarter 3's results, accounting for 34% of all manufacturing projects outsourced from July to September.

- In second place, the Industrial Machinery sector contributed towards 16% of the total outsourcing spend during Quarter 3.

- The Marine industry experienced a surge of activity in the third quarter, putting it in third place with 15% of the total spend.

The top industries represented have undergone a substantial change from Quarter 3 into Quarter 3, with half of the listed sectors appearing as newcomers. Whilst the Defence/Military sector was the biggest contributor towards the total outsourcing spend in the second quarter, this industry has now disappeared from the running altogether in Quarter 3. Instead, the Construction industry appears at the top of the leaderboard from July to September, accounting for 34% of all subcontract purchasing during this period.

Meanwhile, the Industrial Machinery sector places second with a 16% share of the spend in Quarter 3, having appeared in fourth place during Quarter 2. However, the most impressive increase in activity came from the Marine industry, which, having failed to place during the second quarter, now sits in third position and accounts for 15% of the total spend during Quarter 3.

The Furniture industry has also risen slightly in the latest results, ascending from fifth place into fourth. Sitting in its previous position is the Food & Beverage industry, which has also upscaled its subcontract spending significantly and holds 9% of the share.

Further down the results, the Electronics industry has undergone a decline during Quarter 3 and subsequently dropped from third place at 15%, down to sixth place at 8%. Seventh and eighth place are occupied by the Medical/Scientific and the Oil/Chemical/Energy sectors respectively; neither of these industries were seen in the top results during Quarter 2, indicating both have witnessed a surge in activity from July to September.

Elsewhere, a number of industries have dropped out of Quarter 3's results altogether, including Agriculture and Pump & Valve.

About the Contract Manufacturing Index:

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the third quarter of 2020. In order to shed more light on the emerging trends, we have also broken this down by process and industry.