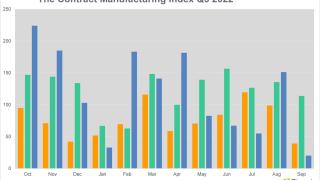

In the face of rising energy prices, coupled with political and economic uncertainty, the latest Contract Manufacturing Index (CMI) reveals that the UK subcontract manufacturing market held steady in the third quarter of the year.

The CMI for Q3 2022 was 102, compared to 101 in Q2 2022, an increase of 1%.

Compared to the equivalent quarter last year the market was down 13%.

Overall, the market was marginally up on the average level of activity during 2021.

Within the top line figures the market in September was around 40% lower than July and August, but initial indications are that the market it is picking up again in October.

Although the overall figures suggest that the market has steadied, there is still a lot of turbulence and uncertainty out there.

The quarter started well but September was very slow across all categories due to a lack of activity in the market. Buyers were obviously waiting to see what the new government would bring and the market was also disrupted by the sad news of the Queen’s death.

October is much better but we have many buyers who are still waiting for clarification and are postponing new projects.

Comparing types of subcontracting, there were sharp differences between machining and fabrication.

The machining market dropped sharply throughout the quarter, falling by two thirds from July to September, but was still up 20% on the previous quarter.

In contrast, fabrication held relatively steady across the quarter, but was down 6% on the previous three months.

Machining accounted for 39% of the total market with fabrication accounting for 54%. Other processes, such as moulding and assembly accounted for the remainder.

As in Q1 and Q2, the strongest sector was Industrial Machinery which grew a further 67% on top of the 10% increase from Q1 to Q2. The second strongest sector was again Food and Beverage, with Construction growing by 50% to move into the third position.

Strong growth in Oil/Chemical/Energy saw it move from thirteenth to fifth.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the second quarter of 2022. In order to shed more light on the emerging trends, we have also broken this down by process and industry.