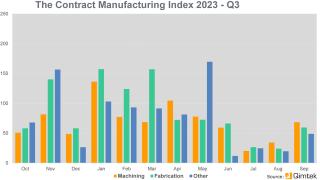

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2023’s data for Quarter T3 is collected from 155 companies and 293 projects.

- Quarter 3's Index decreased by 50% against the preceding quarter.

- All three sub indexes decreased against the previous quarter.

The index is again very low and it is primarily due to very slow July and August with an improvement in September.

This is in line with other indexes but it is lower than I had expected.

We are being promised projects from several buying organisations but they are being pushed into the future month by month.

So we have had a drop of projects this quarter compared to last year and the Quarters 1 & 2. Normally, August is Slow but the whole quartet 3 has been slow.

However, the projects which have come in, more have been awarded and the values of the projects have gone up.

We hope all the promised projects will start coming through in Quarter 4.

Machining

- 64% of third quarter projects were from machining processes

- The buyers of machining processes has a total outsourcing value of £8,196,700 which is a decrease of 49% from the previous quarter and 52% from last year.

Machining had two very slow month but September did pick up and compared to Fabrication and Others, it was better.

Fabrication

- 28% of third quarter projects were from fabrication processes

- The buyers of fabrication processes has a total outsourcing value of £6,912,250 which is a decrease of 47% from previous quarter and is only 1/3 of last year.

Other

- 8% of third quarter projects were from other processes

- The buyers of other processes has a total outsourcing value of £1,203,500 which is a decrease of 64% from previous quarter and 59% from last year.

Industry

As in previous quarters, Industrial Machinery is the largest industry sector this quarter, followed by Communication Equipment and Defence / Military. Electronics and Construction has dropped back this quarter, they are usually high up and Consumer Products has come back which is a bit surprising as the Retail industry is having a tough time.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the 1st quarter of 2023. In order to shed more light on the emerging trends, we have also broken this down by process and industry.