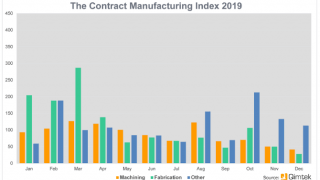

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2019’s data for Quarter 4 is collected from 201 companies and 365 projects.

- Quarter 4’s index has failed to buck the precedent set by the previous two indexes, with records showing an all-time low since the CMI’s inception in 2015.

- This drop was largely due to a substantial shrinkage of the fabrication index, which fell 36% in comparison to Quarter 3.

Quarter 4 is a traditionally slower period due to seasonal shutdowns, although 2019’s was particularly challenging in the midst of political uncertainty and unrest.

Quarter 4’s Contract Manufacturing Index has reported yet another downturn in the UK’s national outsourcing levels. The quarter started on a positive note, displaying heightened activity in comparison to Quarter 3; however, this proved to be a temporary recovery which can more than likely be attributed to stockpiling efforts ahead of the second Brexit deadline.

Moving into November and December, all three indexes started to fall. While machining suffered losses, the fabrication index went into freefall during the final two months of the year, dropping by 36% overall. The ‘others’ index remained the least affected, with a consistent performance from Quarter 3 to Quarter 4.

Meanwhile, the Heavy Vehicles/Construction Equipment sector was responsible for an unprecedented 68% of outsourcing from October to December, dwarfing the output of every other industry. Construction and Industrial Machinery also performed reasonably during this timeframe, although nowhere close to the levels seen at the top of the table.

Quarter 4 is a traditionally slower period due to seasonal shutdowns, although 2019’s was particularly challenging in the midst of political uncertainty and unrest. With another missed Brexit deadline in October and a general election in December, the UK’s industry has understandably had a reluctance to spend any more than is absolutely necessary.

While there could still be trying times ahead now that Brexit is looking certain, we hope that this foresight goes some way in calming the industry’s nerves moving into 2020.

Machining

The latest machining index is consistent with its prevalent trend for 2019 - that is, this index has once again fallen in comparison to the preceding quarter. With a total value of £10,824,230, the machining index underwent a 15% decline during Quarter 4, representing 38% of the total subcontract projects outsourced within this timeframe.

- 38% of the fourth quarter’s projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £10,824,230, compared to a value of £12,799,402 in Quarter 3 2019.

- Quarter 4’s machining index fell by 15% in comparison to the preceding quarter; each quarter of 2019 has reported a drop in the machining index, meaning that the latest report is consistent with the overarching trend.

Fabrication

2019 was an unpredictable year for the fabrication index. Quarter 1 was overwhelmingly positive, displaying the highest value since the index began; however, this all changed during Quarter 2 when the value dropped by 60%. Despite a 5% recuperation during Quarter 3, the final quarter of the year saw another dramatic decrease of 36%. Overall, 41% of Quarter 4’s subcontract engineering projects were for fabrication processes.

- 41% of the fourth quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £11,576,980, which is a 36% decrease against Quarter 3’s value.

- The fabrication index has experienced a rollercoaster ride throughout the course of 2019, beginning the year at its highest value since the index began. Quarter 4 has seen the second-biggest drop of 2019, following a 60% fall for the fabrication index during Quarter 2.

Others

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category makes up 21% of the projects generated within the fourth quarter and is therefore more difficult to monitor. Although this representation is slightly higher than that of Quarter 3, the value of the index has remained more or less the same. This indicates that it is the poor performance of the other two indexes that has led to this rise.

- 21% of the third quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £5,942,295.

- The value of this index remained more or less level from Quarter 3 to Quarter 4, although its representation within the overall index increased from 15% to 21% as a result of the poor performance of both machining and fabrication. Despite a strong October, outsourcing levels in this area during November and December were not enough to result in prominent growth.

Industry

- Displaying unprecedented growth, the Heavy Vehicles/Construction Equipment sector has dominated Quarter 4’s results, accounting for a massive 68% of the market.

- The Construction industry has therefore fallen from first into second place.

- The Industrial Machinery sector has also experienced a positive end to the year, maintaining its grasp on 10% of the subcontract manufacturing spend for the second quarter in a row.

Quarter 4’s outsourcing efforts were dominated by the Heavy Vehicles/Construction Equipment industry, which accounted for a massive 68% of the total outsourcing spend from October to December. Having previously placed third during Quarter 3 with only a 12% share of the index, this growth is unprecedented during a traditionally quieter period across most manufacturing verticals.

The construction industry, having been the forerunner of Quarter 3, declined into second place this quarter. Whereas this sector was responsible for 42% of outsourced manufacturing from July to September, this dropped to just 13% within the final three months of the year. The furniture industry, which previously placed second, has disappeared from Quarter 4’s results entirely, indicating a dramatic tail-off in manufacturing output.

In third place, with a 10% share of the market across both the current and preceding quarters, is the Industrial Machinery sector. Industrial Machinery has performed consistently, although it’s worth noting that the prominence of the Heavy Vehicles/Construction Equipment industry this quarter may have unwittingly diluted and fragmented the results of other sectors.

By the same token, the cumulative share of the bottom half of the table is low, totalling just 9%. Consumer Products accounts for 3% of the manufacturing spend, putting this sector in fourth place. Meanwhile, Automotive and Aerospace each hold 2% of the market, placing them fifth and sixth accordingly. Oil/Chemical/Energy has retained its position in seventh place, with Medical Appliances & Equipment overtaking Medical/Scientific to occupy eighth.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the fourth quarter of 2019. In order to shed more light on the emerging trends, we have also broken this down by process and industry.