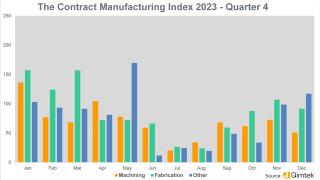

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2023’s data for Quarter 4 is collected from 178 companies and 279 projects.

- Quarter 4's Index increased by 105% against the preceding quarter.

The index did jump back to the normal for the years but it is still low against the first quarter of the year but, it is up 7% over last years quarter 4.

All three sub indexes increased substantially against the previous quarter with Others being the largest winner.

As I mentioned in last quarter, there were several projects which were being held back which have now been released and we are seeing much more activity again both from Buyers and Suppliers.

We have also started to monitor the average lead times for projects and they are averaging 22 days from order. This is based on 10 months of data so it's a bit early but we will keep monitoring an report every quarter.

Machining

- 58% of fourth quarter projects were from machining processes

- The buyers of machining processes has a total outsourcing value of £12,393,520 which about average for the year.

- The index is for machining is up 51% from previous quarter and 3% on previous year.

Fabrication

- 32% of fourth quarter projects were from fabrication processes

- The buyers of fabrication processes has a total outsourcing value of £18,000,590 which is slight above the average for the year.

- The index for Fabrication is 157% on last quarter and 12% on the same quarter 2022.

Others

- 10% of fourth quarter projects were from other processes

- The buyers of other processes has a total outsourcing value of £3 227 410 which a lot higher then average for the year.

- The index for Others is 168% on last quarter but had a small decreased of 1% on the same quarter 2022.

Industry

As usual, Industrial Machinery tops the list with Food & Beverages coming at second place. Defense & Military dropped out of the top 8 while Electronics jumped up to third. Consumer Products stayed in fourth and Construction picked up a few places to fifth place.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the this current quarter. In order to shed more light on the emerging trends, we have also broken this down by process and industry.