Every quarter, Qimtek publishes the Contract Manufacturing Index (CMI) to highlight trends and give insight into the buoyancy of the subcontract manufacturing market.

We do this by monitoring the purchasing budget of companies who are looking to outsource manufacturing within any given month; this reflects a sample of over 4,000 companies with a combined purchasing spend of over £5.2billion, with a verified turnover in excess of £25billion. The information is extracted from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers - it is therefore exclusive to Qimtek, but reflects the health of the overall market.

The following is an overview of 2019’s data as a whole, showing how the individual indexes performed over the course of the year and which industries outsourced the most.

Key Points:

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2019’s data is collected from 547 companies and 1,761 subcontract engineering projects.

- The Index is down 35% compared to 2018.

- The Machining Index is down 35% on 2018’s data.

- The Fabrication Index has decreased by 32% this year.

- The ‘Others’ Index - accounting for niche processes such as toolmaking, casting, moulding and finishing - is down from the previous year by 32%. This is the first time this index has declined from year to year.

Commentary:

2019 started strongly for the Contract Manufacturing Index which recorded its second-highest result in eighteen months during Quarter 1. By the end of March, the Fabrication Index had grown by a staggering 66% on the preceding quarter, while the Machining Index had also begun to recover from its pronounced decline in December 2018. These results bore testament to the reports of industry stockpiling ahead of the original Brexit deadline, which brought a strong increase of activity to UK manufacturing and engineering. However, an upwards trajectory was not unanimous across the board, as the Others Index tumbled by 66% against Q4 2018.

Quarter 2 reported inverted results against Quarter 1, with both the Machining Index and the Fabrication Index decreasing their output substantially. In turn, the value of the overall index went into freefall, reaching its lowest levels since the CMI’s inception in January 2015. The aforementioned decline can be largely attributed to scaled-back outsourcing amongst larger companies, with the West Midlands demonstrating a lower output in particular. Nonetheless, the Others Index displayed a strong performance, regaining the ground it lost during Quarter 1 with a 66% value increase.

Unfortunately the value of the CMI fell further still in Quarter 3. While the Fabrication Index experienced a slight increase of 5% from July to September, both the Machining Index and the Others Index took a nosedive during the same period. Although traditionally a slower month for the manufacturing industry overall, the Machining Index performed well during August; however, a stunted July and September meant that this particular index slumped by 31%. Meanwhile, the Others Index fell by 24%, despite also experiencing a comparatively strong August.

Quarter 4 marked the peak of the UK’s political unrest to date, with both another missed Brexit deadline at the end of October and a general election in December. Unsurprisingly, this did little to boost the manufacturing industry’s confidence and subsequently, output levels fell even lower than the previous quarter. While second-wave stockpiling efforts gave the index a gentle nudge during October, November and December proved challenging for all three indexes. Overall, the Machining Index dropped by 15%, while the Fabrication Index’s decrease was more pronounced at 36%. However, Quarter 4 didn’t spell outright doom and gloom for UK manufacturing due to consistent levels of outsourcing amongst specialist processes from Quarter 3 to Quarter 4, meaning that the Others Index remained static.

Trend Overview:

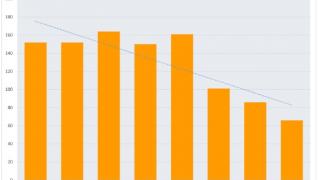

The bar graph above shows the values of each index month to month, with the Machining Index shown in orange, the Fabrication Index shown in green and the Others Index shown in blue.

The value of all three indexes has dropped over the course of the year by approximately one third. Both the Machining Index and the Fabrication Index display clear downwards trend over the course of 2019, with fabrication suffering the most pronounced decline of all of the indexes. However, the Others Index showed a slight a slight upwards trajectory towards the end of the year, with the most challenging months mostly limited to the second and third quarters. This is a positive prelude to this index’s performance going into 2020.

Distribution of Projects:

The table below shows the distribution of projects across all three indexes in 2017, 2018 and 2019 respectively:

201720182019

Machining55%53%43%

Fabrication37%39%44%

Others7%8%13%

As you can see, fabrication overtook machining as the most commonly sought-after group of processes during 2019, although the split between the two was by and large equal. Machining has lost group to fabrication year on year since 2017, with the latter gaining more of a stronghold every year in turn.

Specialist processes have also become more popular, gaining 5% more of the total project distribution from 2018 to 2019. However, as noted in previous editions, its increasing popularity could be due to the Qimtek sourcing team’s focus on the generation of these projects for our specialist members.

Share of Outsourcing Values:

As you can see from the chart below, the split of the total outsourcing values remained almost unchanged from 2018 to 2019; however, it is important to note that the underlying data has doubled over the past twelve months. This means that the total outsourcing value of all of our buying organisations has grown to £5billion.

Top Industries:

Oil/Chemical/Energy failed to make an appearance in 2018’s top eight industries overall, but surged to the very top of 2019’s results.

The top industries represented in the outsourced manufacturing spend changed from 2018 to 2019. While the top three industries previously consisted of Heavy Vehicles/Construction Equipment, Industrial Machinery and Electronics, the latest results saw this change to Oil/Chemical/Energy and construction, with Heavy Vehicles/Construction Equipment in third place.

Oil/Chemical/Energy failed to make an appearance in 2018’s top eight industries overall, but surged to the very top of 2019’s results. However, it’s worth noting that this is largely due to this sector’s astonishing spend during Quarter 1, with absolutely no representation during Quarter 2 and marginal positioning in Quarters 3 and 4. Its 45% share of the market from January to March - a time where pre-Brexit preparations were at the forefront of the contract manufacturing industry - hints that Oil/Chemical/Energy may have been the main contributor towards stockpiling efforts.

The Construction industry was also another notable climber during 2019, having featured in eighth place the previous year. This sector behaved much less erratically than Oil/Chemical/Energy, with consistent outsourcing levels that saw it place first, second and fourth at different intervals. Quarters 2 and 3 witnessed the most prominent performances from Construction, while Quarter 4 also saw substantial activity from this sector.

Meanwhile, the key player of 2018, Heavy Vehicles/Construction Equipment, slid down into third place for 2019. Despite a mid-range output during the first quarter, this industry featured in the top three for the remainder of the year. The most notable period for the Heavy Vehicles/Construction Equipment industry was Quarter 4 which saw its activity levels rocket, meaning that this sector accounted for an incredible 68% of all contract manufacturing spending during the final three months of the year. Despite losing its place at the top of the leaderboard, Heavy Vehicles/Construction Equipment actually increased its contract manufacturing spend from 2018 to 2019; however, it was simply dwarfed by the unprecedented rise of both Oil/Chemical/Energy and Construction.

Elsewhere, the Medical/Scientific industry more than tripled its spend, while Defence/Military also increased its contributions exponentially. The same could not be said for Industrial Machinery, Furniture and Electronics however, all of whom fell to the bottom of the table, while Food & Beverage disappeared from the latest results entirely.

Conclusion

There can be no doubt that 2019 was one of the most difficult years experienced by the contract manufacturing industry in recent times.

There can be no doubt that 2019 was one of the most difficult years experienced by the contract manufacturing industry in recent times. While the year started with a strong performance by both the Fabrication Index and the Machining Index, Quarters 2 through to 4 were not kind to either one, with consistent drops to machining activity and an erratic - but ultimately negative - trajectory set by fabrication. Elsewhere, the Others Index started the year poorly but maintained a level trend, with slight recuperation shown by the final quarter.

2019 also brought a shake-up to the top industries contributing towards the overall contract manufacturing spend. While Oil/Chemical/Energy had the highest spend, it could be speculated that this was largely due to stockpiling efforts ahead of the original Brexit deadline. A number of industries multiplied their spending within 2019 - namely Construction, Heavy Vehicles/Construction Equipment, Medical/Scientific and Defence & Military - whereas some of last year’s forerunners scaled back their activity over the past twelve months.

It is not surprising given the political climate that 2019 has birthed such a disappointing result for most of the UK’s contract manufacturing market. While we are certainly not out of the woods as the next Brexit deadline looms, we remain hopeful that the newfound clarity of the UK’s political future will give the industry some degree of short-term foresight. Ultimately, we hope that 2020 brings some stability to the index and the contract manufacturing industry overall, although the viability of this scenario remains to be seen.