Every quarter, Qimtek publishes the Contract Manufacturing Index (CMI) to highlight trends and give insight into the buoyancy of the subcontract manufacturing market.

This data is exclusive to Qimtek, but reflects the health of the overall market.

We do this by monitoring the purchasing budget of companies who are looking to outsource manufacturing within any given month; this reflects a sample of over 4,500 companies with a combined purchasing spend of over £5.8billion, with a verified turnover in excess of £26billion. The information is extracted from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers - it is therefore exclusive to Qimtek, but reflects the health of the overall market.

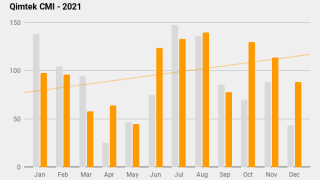

The following is an overview of 2021’s data as a whole, showing how the individual indexes performed over the course of the year and which industries outsourced the most.

Key Points:

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2021’s data is collected from 1,004 companies and 1,407 subcontract engineering projects.

- The Index has grown by 10% from 2020 to 2021.

- The Machining Index is down 1% on 2020’s data.

- The Fabrication Index grew by 28% last year.

- The ‘Others’ Index - accounting for niche processes such as toolmaking, casting, moulding and finishing - dropped 19% in 2021.

Commentary:

The overall buoyancy of the Contract Manufacturing Index was fairly strong at the start of 2021.

The overall buoyancy of the Contract Manufacturing Index was fairly strong at the start of 2021, having undergone an extremely difficult and unprecedented period during the height of the COVID-19 pandemic in 2020. In comparison to the fourth quarter of 2020, the Index grew 25% from January to March 2021, with the strongest output consigned to the earlier months before a tail-off in activity during March. However, the average order value reached record levels during this time, which hinted at less speculation within enquiries and more orders being placed.

However, the Index fell during the second quarter of the year, reporting an 8% decline overall. This was most widely seen within the Fabrication and Others Indexes, which recorded a 25% and 22% drop respectively. Conversely, the Machining Index grew by 120% in comparison to Quarter 1, whilst the number of projects awarded continued to rise, reaching its peak during June 2021. The Index reached its lowest value of the year during May, but had once again recuperated by the quarter's close.

During quarter 3, the effects of the worldwide materials shortage became evident within the data.

This recovery set the Index up for a positive third quarter, during which time the overall value of the Contract Manufacturing Index climbed by 52%. However, during this period, the effects of the worldwide materials shortage became evident within the data, with the average number of quotes received per project falling below the eight-year average of 2.8. This indicated bottlenecks within the supply chain and suppliers being hesitant to commit to taking on new projects. Nonetheless, July and August were largely positive for all three Indexes, before a decline in activity became apparent during September.

The Machining Index was especially hard-hit during the fourth quarter.

This trend continued into the final quarter of 2021, with a decline of 6% in the value of the Index overall. However, it is important to note the boost in subcontract activity which took place in October, whilst incremental decreases occurred from month to month across the remainder of the year. The Machining Index was especially hard-hit during the fourth quarter, whilst the Fabrication and Others Indexes actually saw comparative growth in relation to the third quarter.

Trend Overview:

The bar graph above shows the values of each index month to month, with the Machining Index shown in orange, the Fabrication Index shown in green and the Others Index shown in blue.

Given the factors at play during the first half of the year, it is not surprising that a majority of activity was reserved for the latter half of 2021.

The data shows that the trajectory of each index was changeable throughout the year, although the levels of all three indexes significantly fell within May, before recuperating in June. May 2021 was the lowest month in terms of overall output, with the Index having steadily declined within the preceding months of the year. However, the second half of the year proved to be much more buoyant, although it is important to note that there were fluctuations between the individual indexes. Given the factors at play during the first half of the year, including the finalisation of Brexit and the UK's third national lockdown, it is not surprising that a majority of the UK subcontract engineering sector's activity was reserved for the latter half of 2021.

The Machining Index peaked in June 2021, whilst the Fabrication Index reached its highest level of the year during August - perhaps unusual given the historic seasonality of work in line with staff summer holidays. Meanwhile, the Others Index didn't reach its climax until October, before declining in steady increments across November and December.

Distribution of Projects:

The distribution of projects remained more or less consistent across 2020 and 2021.

The distribution of projects across the individual indexes remained more or less consistent across 2020 and 2021, albeit with some slight changes. The Machining Index's project share fell by 1% during 2021 to 55%, having held a 56% share of the projects in 2020. The Others Index also receded by 5% with an 8% share of the projects generated, having accounted for 13% of the total projects generated within both 2019 and 2020.

However, the Fabrication Index grew its project share by 6% last year, rising from 31% to 37%. This was following a significant decrease of 13% from 2019 into 2020, showing that the fabrication sector is once again gaining ground.

Share of Outsourcing Values:

The overall value grew by 10% in 2021.

The overall value of the Contract Manufacturing Index grew by 10% in 2021. The Machining Index continued to contribute the most value at 44%, whilst the Fabrication Index only fell 2% behind with a 42% share. The Others Index - historically the lowest contributor - contributed 15% of the total outsourcing value.

Number of Parts Outsourced:

The data showed a slight increase in the number of individual parts outsourced.

The data showed a slight increase in the number of individual parts outsourced from 2020 to 2021, reporting growth of 12%. This shows that the industry was more active as a whole in 2021, with more subcontract opportunities available to suppliers. However, it still falls short of levels seen in 2019, before the arrival of the COVID-19 pandemic.

Top Industries:

- The Industrial Machinery sector accounted for the most outsourcing activity of any industry during 2021, with a 31% share. This sector placed top during quarters 1, 3 and 4.

- In second place, the Electronics industry held a 15% share of 2021's subcontract purchasing activity and placed first in the second quarter.

- Heavy Vehicles/Construction Equipment came in third place overall - this sector was absent from quarter 1's results, but consistently placed third across the third and fourth quarters of 2021.

- 2020's forerunner - the Construction industry - fell to fourth place in 2021.

The Industrial Machinery sector prevailed as the top contributor to subcontract purchasing.

There were quite a few dramatic changes within the industry data from 2020 to 2021. The Industrial Machinery sector prevailed as the top contributor to subcontract purchasing last year, having previously placed third during 2020. This industry delivered a consistent performance across the year, having placed first within quarters 1, 3 and 4, only temporarily falling to fourth place during the second quarter. The Electronics industry also gained ground, placing second for 2021 overall after finishing the previous year in fourth place. This sector was the industry leader for quarter 2, but also placed third and second during quarters 1 and 4 respectively.

Electronics was the industry leader for quarter 2, but also placed third and second during quarters 1 and 4 respectively.

In third place, the Heavy Vehicles/Construction Equipment sector experienced quite a pronounced surge in activity during 2021, after finishing seventh overall in 2020. This industry was absent from quarter 1's results, before emerging in sixth position from April to June, then maintaining third position across the entirety of the second half of the year. In fourth place is 2020's forerunner - the Construction industry - which was present across all four quarters in positions ranging from second to fifth.

Meanwhile, further down the board, the Furniture sector finished 2021 in fifth position overall. This industry had a great start to the year and placed second across the first and second quarters, but disappeared from the results during quarter 3 before re-emerging in fifth position during the final quarter. It's interesting to note that the Furniture industry also placed fifth within the overall results for 2020, meaning that despite its fluctuations from quarter to quarter, its performance has been consistent when looking at the data in its entirety.

A number of 2020's top industries fell away during 2021.

The Automotive sector rose from ninth into sixth place during 2021, although this sector only made one appearance within the top industries per quarter, placing sixth during quarter 4. The Consumer Products and Communication Equipment sectors didn't place during 2020, but finished in seventh and eighth place respectively for 2021.

A number of 2020's top industries fell away during 2021. These include Oil/Chemical/Energy (which previously placed second), Food & Beverage (which finished 2020 in sixth place overall) and Marine (which came in eighth place during 2020).

Conclusion:

2021 was always destined to be a difficult year for the industry.

2021 was the second year affected by COVID-19 and it is therefore no surprise that the index values did not bounce back to pre-pandemic levels. Compounded by the finalisation of Brexit, as well as the worldwide materials shortage, 2021 was always destined to be a difficult year for the industry. However, there was some growth in the values represented by the Index - particularly within the fabrication sector, which grew by 28% over the course of the year.

The Industrial Machinery sector performed more or less consistently as the top industry contributing to outsourcing efforts during 2021. The Electronics industry was also relatively stable as the second-biggest outsourcer, whilst sectors such as Construction fell in terms of output. Perhaps the most notable example is the Oil/Chemical/Energy industry, which disappeared from 2021's results altogether having placed second during 2020.

The materials shortage continues to make suppliers hesitant to commit to taking on new projects.

The materials shortage continues to make suppliers hesitant to commit to taking on new projects, as reflected in the decline of the average number of quotes received per project to just 2.6 during quarter 4. This is likely to be an ongoing issue for the industry and will no doubt make itself known once again in 2022's data. However, Brexit's finalisation has seen a number of manufacturers reshoring their supply chains, spelling an increase in potential opportunities for UK suppliers moving into 2022.

Manufacturing buyers are reporting that there is likely to be a surge in outsourcing over the next year.

Now that we are through the worst of the COVID-19 pandemic, manufacturing buyers are reporting that there is likely to be a surge in outsourcing over the coming twelve months, which will undoubtedly lead to an increase in the Index's value if it materialises. The main issue currently facing the industry is keeping up with demand in light of a shortage of resources - it is yet to be seen whether there will be any resolution as 2022 progresses.