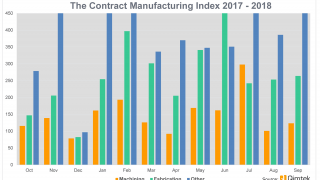

Following a similar trajectory to the Markit CIPS Purchasing Managers’ Index, quarter 3 shows a busy July, followed by an incredibly slow August. But will September’s attempt at a recovery be enough to drive positive growth for the manufacturing industry?

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and the following is a summary of our findings for the third quarter of 2018. In order to shed more light on the emerging trends, we have also broken this down by process and industry.

Key points:

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2018’s data for quarter 3 is collected from 311 companies and 474 projects.

- Quarter 3’s results are down 1% from the preceding quarter and are up 4% on the comparable quarter for 2017.

Machining

Following a fall of 12% in quarter 2, quarter 3’s results have boded well for the machining sector and reflect a 23% rise. This once again brings the findings back into the black when compared to 2017’s third quarter, with a further 14% increase evident in the latest figures. This is especially encouraging when the overall expansion of 2017’s machining index is taken into account. The growth reported in the latest results is largely due to a massive influx during July 2018, followed by much less dramatic activity during August and September.

- 52% of the third quarter’s projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £26,990,310.

- Quarter 3’s machining index grew by 23% in comparison to the preceding quarter - a rise of 14% in relation to the third quarter of 2017.

Fabrication

The fabrication index has gone from strength to strength during 2018; however, the third quarter bucked the trend, showing a 24% decrease against quarter 2. Having undergone a dramatic incline from April to June, the index fell suddenly in July 2018 and minimal - yet continued - growth has been reported ever since. Furthermore, these latest results are down by 14% against the comparative quarter for 2017.

- 40% of the third quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £26,589,263.

- The fabrication index shrunk by 24% in comparison to 2018’s quarter 2, with the latest results also showing a 14% decrease against 2017’s comparative quarter 3 index.

Others

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category only makes up 8% of the projects from the third quarter and is therefore more difficult to monitor. However, the results show that the index for this category has increased by a massive 46% on the previous quarter, with growth of 67% on quarter 3 2017 further still. This means that the index has more than recuperated from the 26% fall it experienced within the preceding three months.

- 8% of the first quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £7,818,570.

- The index for these processes grew by 46% compared to the second quarter of 2018 and by 67% in relation to the third quarter of 2017.

Industry

- Having experienced a disappointing second quarter, the automotive sector has now jumped right to the top of quarter 3’s results, representing 19% of the market.

- The furniture industry has retained its position in second place for the second quarter running, accounting for 16% of the market.

- Electronics companies have increased their outsourcing substantially, which has moved them into third place. Having only held a 6% share of quarter 2’s market, electronics now constitutes 13% of the index from July to September 2018.

The third quarter has brought with it a shake-up to the top industries represented, with only one of the previous quarter’s top three retaining its position into the following quarter. Whilst the furniture sector has managed to maintain second place, it’s important to note that its percentage of the market has dropped from 19% to 16%. Nonetheless, this has not affected its standing due to the much more even market distribution demonstrated in quarter 3’s findings.

In quarter 2, the heavy vehicles/construction equipment sector largely dominated the results, accounting for a massive 43% of the respective market. This dramatically dropped to 9% from July to September, sending heavy vehicles/construction equipment down into seventh place and leaving the top of the table free for the automotive industry to make a comeback. This sector had fallen out of the top industries altogether during the second quarter, but now with renewed strength it places first, holding 19% of the market.

The electronics sector also performed exceptionally well during quarter 3, taking it from fourth place into third. Once again, the pronounced fallback of the heavy vehicles/construction equipment industry and the resulting redistribution, meant that the electronics industry went from representing 6% of the market to 13% - more than doubling its output in relation to the market as a whole.

The medical/scientific sector also experienced a fruitious third quarter, having placed fourth overall with a 12% share. Other industries which saw an uplift this quarter include food & beverage (10% and sixth place), as well as construction (9%, placing eighth).

This is in stark contrast to the industrial machinery sector which declined from third place into fifth, although it can be observed that its representation only fell by 2% from quarter 2 to quarter 3.

Summary

Whilst the second quarter reported substantial growth, 2018’s quarter 3 results portray a much more turbulent climate within the manufacturing industry. These findings are consistent with those of the Markit CIPS Purchasing Managers’ Index, which also shows erratic fluctuations in manufacturing output from July through to September.

The quarter got off to a strong start, especially in relation to the machining and ‘others’ indexes, which increased exponentially over the course of July. Unfortunately, this trend did not prevail throughout the remainder of the quarter, with August recording huge drops in both of the aforementioned indexes, followed by slight recovery during September.

The fabrication market seems to defy that of its counterparts, tailing off dramatically during July and reporting minimal growth over both August and September.

Quarter 3 also witnessed the fall of the heavy vehicles/construction equipment sector, which had previously served as a dominating force from April to June. Furthermore, the automotive industry underwent a huge surge in manufacturing output, taking it to the top of Q3’s leaderboard after having dropped out of the running altogether during quarter 2.

Whilst the index for quarter 3 has been less positive, it has surely made for a rollercoaster ride, leading with uncertainty into 2018’s final quarter. We’re hopeful that September’s attempt at recuperation will set a constructive precedent for the index during quarter 4; however, at this stage it cannot be claimed with conviction and a degree of unpredictability presides over all of the top industries and sub-indexes.