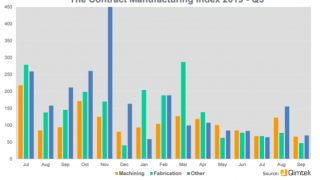

- The Index is split into three processes - Machining, Fabrication, and Others.

- 2019’s data for Quarter 3 is collected from 284 companies and 511 projects.

- Quarter 2’s Index was the lowest since the Index was first published in Quarter 1 of 2015 - Quarter 3’s Index has dropped further still.

- Although the number of projects is comparable to previous quarters, the size ›of purchasing companies has shrunk dramatically - subsequently, so has the overall purchasing budget. The total outsourcing value for Quarter 3 is £36,647,320.

Quarter 3’s Contract Manufacturing Index has recorded a further drop from Quarter 2 - a period during which the Index reached its lowest levels since its inception at the start of 2015. Although the Fabrication Index demonstrated slight growth from July to September, the Machining and ‘Others’ Indexes fell significantly during the same time period. This has had a detrimental impact on the Index overall.

Although Quarter 3 saw a similar number of subcontract engineering projects as its predecessors, the size - and therefore, the spend - of the companies outsourcing these projects has shrunk, resulting in a downsizing of the contract manufacturing market’s scope. The construction industry has once again been a key player in outsourcing activity this quarter, although its spend has dropped dramatically; meanwhile, the furniture and heavy vehicles/construction equipment sectors have also made a significant contribution to our national outsourcing efforts.

With no further clarification surrounding the UK’s political future - and the Brexit deadline fast approaching - it seems that uncertainty is preventing larger OEMs from outsourcing any more than is absolutely necessary. Many subcontract engineering suppliers have reported that they are now having to look for work outside of their existing client base - an unavoidable result of this restricted spending.

The final quarter of the year will hopefully offer some clarity to our nervous industry and a return to a positive trajectory for the Index; however, it is too early to predict just how pronounced any possible growth may be.

Machining

The Machining Index underwent a dramatic 35% drop against Quarter 2.

2019 has not boded well for the machining index, which has seen a steady decline throughout the year. Unfortunately, this trend has continued into Quarter 3 with a dramatic 35% drop against Quarter 2. Somewhat surprisingly, August saw a slight rise in the value of the machining index, but the low levels of machining outsourcing during July and September weighed the overall value of this index down over the entire duration of the quarter.

- 35% of the third quarter’s projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £12,799,402, compared to a value of £18,653,248 in Quarter 2 2019.

- Quarter 3’s machining index fell by 31% in comparison to the preceding quarter - a trend that has prevailed throughout 2019 thus far.

Fabrication

The Fabrication Index is gently following a positive trajectory that could gain traction during the final quarter of 2019.

The fabrication index has undergone a turbulent year, with plenty of highs and lows. The first three months saw it reach its highest value since the inception of the Contract Manufacturing Index in Quarter 1 of 2015, followed by a fall of 60% in Quarter 2. Quarter 3’s index shows a 5% increase on the previous quarter and while this is not enough to secure a certain recovery, this index is gently following a positive trajectory that could gain traction during the final quarter of 2019.

- 50% of the second quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £18,218,025, which is a 5% increase on Quarter 2’s value.

- Having reached its highest value in Quarter 1, the fabrication index fell by a gargantuan 60% during Quarter 2. The latest results are not enough to show that a recovery is certain, although they do reflect a gentle recuperation.

Others

The third quarter has seen lower levels of outsourcing in these areas, with little fluctuation from month to month.

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category makes up 15% of the projects generated within the third quarter and is therefore more difficult to monitor. The index grew and shrank by equal amounts over the first six months of the year; however, the third quarter has seen lower levels of outsourcing in these areas, with little fluctuation from month to month. Overall, the value of the ‘Others’ index has decreased by 24% this quarter, defying the growth exhibited during the comparable quarter of 2018.

- 15% of the third quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £5,629,845.

- This index saw a 66% slump in Quarter 1, followed by a 66% rise in Quarter 2. Unfortunately the third quarter showed a marked decline in the outsourcing of these processes, with little fluctuation from month to month. In turn, this has resulted in a 24% decrease for this particular index.

Industry

- For the second consecutive quarter, the Construction industry has accounted for the most outsourcing, making up 42% of the contract manufacturing spend during Quarter 3.

- The Furniture industry has seen a surge in outsourcing activity during Quarter 3, taking it from eighth place into second.

- This has pushed the Heavy Vehicles/Construction Equipment sector down into third place for this quarter.

Construction’s overall spend fell dramatically during the third quarter, meaning that the poor performance of other sectors may have largely contributed to its stronghold.

The Construction industry has continued to thrive during Quarter 3, accounting for 42% of all outsourcing during this period. This sector has now topped the table for two quarters in a row, with a 51% share of the market from April to June. Construction’s sizeable share of the results over both periods indicates a dramatic upturn in activity - for comparison purposes, this sector only accounted for 10% of Quarter 1’s contract manufacturing purchasing. However, Construction’s overall spend fell dramatically during the third quarter, meaning that the poor performance of other sectors may have largely contributed to this stronghold.

In second place, the Furniture industry maintains a grasp on 13% of outsourcing during Quarter 3, having previously entered in eighth place during Quarter 2. The surge shown by this sector has had a knock-on effect on the Heavy Vehicles/Construction Equipment industry, which has vacated into third place with a 12% share of outsourcing activity.

Elsewhere, Quarter 3 has also proven to be positive for the Industrial Machinery sector, which has secured its position in fourth for the second consecutive quarter; albeit with a slightly larger share of the market. However, the reduction in the size of the Index overall means that Industrial Machinery’s 7% share in Quarter 2 translated to a spend of £18,971,560, whilst its 10% share in Quarter 3 equates to a lesser spend of £17,631,035.

Meanwhile, the Automotive sector increased its outsourcing spend during Quarter 3, taking it into sixth place from fifth. Having undergone a period of erratic purchasing activity, the Electronics industry now occupies sixth position and has more than halved its contract manufacturing spend from Quarter 2 to Quarter 3. However, this was not the case for both the Oil/Chemical/Energy and Medical/Scientific sectors who both increased their purchasing efforts from July to September, placing them seventh and eighth respectively.

The shakeup in the top industries represented has meant that a couple of sectors fell out of the running altogether during Quarter 3, including Defence/Military and Appliances.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the third quarter of 2019. In order to shed more light on the emerging trends, we have also broken this down by process and industry.