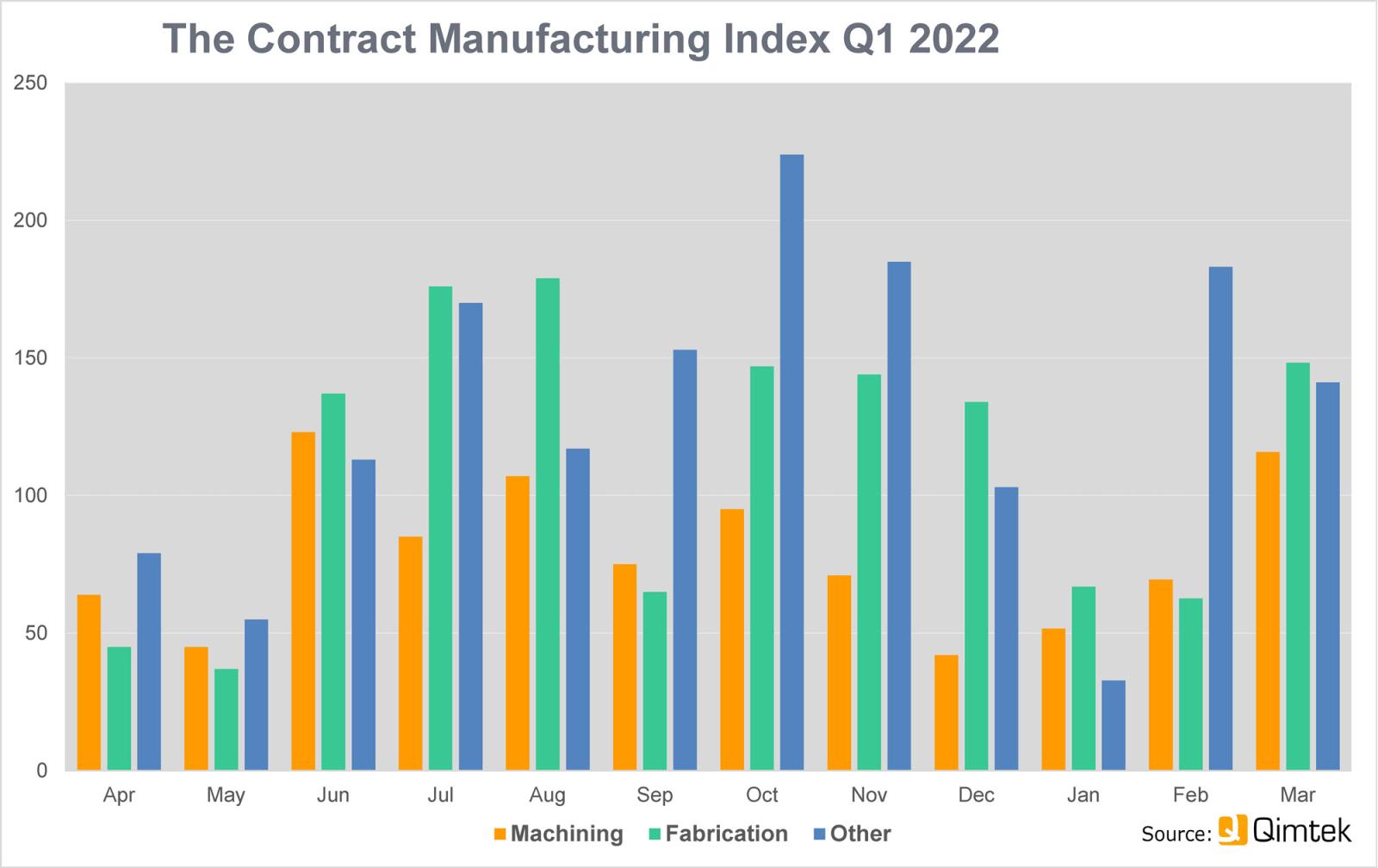

The latest Contract Manufacturing Index has revealed a fall in the subcontract manufacturing market of 19% in the first three months of 2022 compared to the final quarter of 2021.

The quarter started badly, with January showing a sharp decline from an already poor December. It started to pick up strongly in February and by March it was 20% up on the average for the previous quarter – with suppliers winning work despite soaring energy prices, continuing material supply worries, and the war in Ukraine.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3.4bn and a supplier base of over 7,000 companies with a verified turnover in excess of £25bn.

The baseline for the index is 100, which represents the average size of the subcontract manufacturing market between 2014 and 2018.

The CMI for the first quarter of 2022 was 89 compared to 110 in the final quarter of 2021 and 84 in the equivalent quarter last year.

Within the latest figures there was a strong increase in machining business – representing 42% of the market and up 14% on the previous quarter. Fabrication accounted for 46% of the market with the remaining 12% including other processes such as moulding and electronic assembly.

The strongest industry sectors were, in order of value, Industrial Machinery, Electronics, Furniture, Heavy Vehicles / Construction Equipment and Trucks & Transportation (non-automotive). This final category more than doubled in value compared to the previous quarter.

The most notable faller was Automotive, dropping from third to eleventh place.

Commenting on the figures, Qimtek owner Karl Wigart said: “Although at first sight the figures are disappointing, when you look more closely it is clear that the was a big jump in March, especially in machining.

“Our own experience is that activity has been very similar to last year and we hear that some suppliers are still wary of quoting on new work because of supply chain issues and staff resources.

“The evidence is there, though, that demand is ramping up, more of our suppliers are winning work and the outlook for the next quarter is promising.”