The UK contract manufacturing market was up 12% in 2016 compared to 2015, but showed weakness in Q3 and Q4

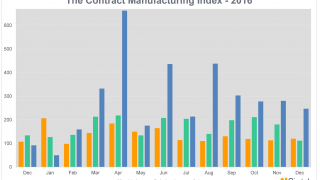

The latest Contract Manufacturing Index figures show that the market for contract and subcontract manufacturing was up by 12% in 2016 compared to the previous year, at 161 compared to 144. The baseline index of 100 represents the average value of the subcontracting market in 2014 – so the increase over two years is 60%.

In 2016, 49% of the market was for machining, 41% for fabrication, and 10% for other processes such as electronics manufacturing and moulding. This compares with 49%, 47% and 4% respectively.

The final quarter of 2016 (Q4), however, showed an overall fall of 4% on the previous quarter (Q3), which was already down on the first half of the year (Q1 & Q2).

The CMI for Q4 2016 stood at 147 compared to 153 in Q3 2016 – a drop of 4% – but was still up on the equivalent period in 2015 by 2%.

Within those figures, machining was slightly up on Q3 by 1.7%, while fabrication fell back 7.3% and other processes by 16%.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3bn and a supplier base of over 7,000 companies with a verified turnover in excess of £25bn.

The latest quarter of the CMI index is more in line with the Office for National Statistics figures, which show a fall in manufacturing, rather than the Manufacturing PMI which rose during the last quarter.

As in Q3, it is the machining sector that is pulling the overall figure down. In each month of the quarter the CMI was below its average for the year of 144.

Fabrication was just over the average for October and November but, as is generally the case, dropped below in December. Other processes remained strong and were 300% up on Q4 2015.

The volume of projects being outsourced in the period was about average, so the variation in value is more down to the type of companies that are placing projects.

There are some large outsourcing companies placing projects but, since July, there have been fewer machining projects being placed by these companies.