According to a our new manufacturing index, the value of contract and subcontract manufacturing in the UK engineering sector was 18% higher over the course of 2015 than it was in 2014. In the last quarter the value of the UK contract and subcontract sector was 15% higher than in the previous quarter and 32% higher than in the corresponding period in 2014.

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This reflects a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 companies with a verified turnover of in excess of £25bn.

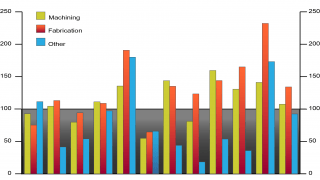

The index takes as its datum a figure of 100 for the average value of active sourcing budgets on a monthly basis throughout 2014 – on this basis, the overall index value for 2015 was 118 and the average index value for the final quarter was 144.

On a process by process basis, machining orders increased by 12% in 2015 compared to 2014, and dropped by 1.4% in Q4 2015 compared to Q3 2015. Machining orders in Q4 2015 were 32% higher than in Q4 2014.

Fabrication orders increased by 32% in 2015 compared to 2014 and rose by 32% from Q3 2015 to Q4 2015. Fabrication orders in Q4 2015 were 53% higher than in Q4 2014.

Overall machining accounted for 54% of the business covered by the survey, with fabrication accounting for 41% and the remainder including plastics moulding and electronics.

Looking by sector, the majority of the sourcing budget fell into fairly wide classifications including ‘industrial machinery’ and ‘other’. Where a specific end market sector was quoted, the most important were (in decreasing order) construction, electronics, oil/chemical/energy, medical/scientific and automotive.

Commenting on the launch of the Contract Manufacturing Index, Qimtek owner Karl Wigart said: “It has always been difficult, if not impossible, to put an accurate figure on the volume of contract and subcontract manufacturing in the UK. There are no agreed definitions as to what the terms cover and no way of separating them out in UK or EU manufacturing output statistics. With the introduction of the Qimtek Contract Manufacturing Index, we finally have a way of understanding how the market is moving, even if we can only guess at absolute values.”