The contract manufacturing market was 19% down in Q3 2016 compared to Q2 but 21% up on Q3 2015

In contrast with more general indicators of activity for the manufacturing sector, the latest Qimtek Contract Manufacturing Index (CMI) shows that the value of the UK contract and subcontract manufacturing market dropped by 19% in the third quarter (Q3) of 2016 compared to the second quarter (Q2).

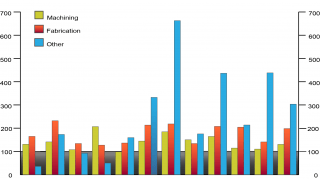

The market for machining was low throughout Q3, although it did show some signs of recovery in September. Fabrication, in contrast only fell back slightly from the previous quarter. August was a quiet month but July and September were relatively strong. Other processes, including plastic moulding and electronics, were almost as weak as machining but were at their strongest in August.

The long-term trend was still strong, with the CMI rising from 126 in the third quarter of 2015 to 153 a year later – a rise of 21%.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3bn and a supplier base of over 7,000 companies with a verified turnover in excess of £25bn.

The base line figure of 100 represents the average value of the subcontracting market during 2014.

Looking further into the figures, machining was down by 29% in Q3 2016 compared to Q2 2016, and also down 8% year on year. It represented 44% of the total market as against 50% last quarter.

Fabrication was the strongest performer, dropping by only 2.6% on the previous quarter, and represented 45% of the market.

Other processes fell by 25% quarter on quarter, but were 724% up on a low base a year ago – they represented 11% of the total market.

Commenting on the latest Contract Manufacturing Index figures, Karl Wigart, owner of Qimtek, said: “Considering the resilience the contract manufacturing market showed immediately after the Brexit vote, at first glance it is not obvious what has changed. What we are finding though is that we are still getting plenty of projects, but not so many high-value ones from large organisations.

“This has been particularly noticeable in machining over the past three months. Maybe Brexit is making the large organisations hesitate and the smaller agile ones are making the most of it?”