- The Index is split into three processes - Machining, Fabrication, and Others.

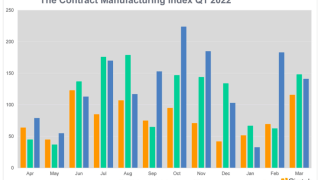

- 2022’s data for Quarter 1 is collected from 253 companies and 379 projects.

- Quarter 1's Index fell by 20% against the preceding quarter but a 6% growth compared to last year.

- The Machining Index recorded growth this quarter, whilst the Fabrication and Others Indexes declined. This is the opposite of the activity displayed during the final quarter of 2021.

- The average number of quotes received per project fell to 2.3, down from 2.6 in the previous quarter.

The start of 2022 has brought with it a decline in the Contract Manufacturing Index. With a drop of 20% against the final quarter of 2021, the latest results show that the year began slowly across the board, with stunted levels of outsourcing in all areas. The low levels of activity in January were largely responsible for the overall decline - whilst February was slow in some areas, March held a value of 140, which was the largest seen in over two years.

Despite the decline in value, the theme of the latest Contract Manufacturing Index is growth.

Delving into the individual indexes, we see that the trends of quarter 4, 2021 - during which time the Machining Index declined, whilst the Fabrication and Others Indexes went from strength to strength - have now been reversed. The Machining Index was the sole climber from January to March, recording growth of 14% from 2021 into 2022 - meanwhile, the Fabrication Index and Others Index fell by 35% and 30% respectively. Nonetheless, it is interesting to note the trajectory of the indexes - whilst the Machining Index follows a flat trend, the Fabrication and Others Indexes show ascension.

The average number of quotes received per project also fell during the first quarter of 2022, down to 2.3 against the previously-reported figure of 2.6 during the final quarter of 2021. This illustrates the hesitancy of suppliers to commit to taking on new projects in light of a shortage of materials and resources - without the guarantee of either, suppliers are left wondering whether they will be able to fulfil their obligations.

Despite the decline in value, the theme of the latest Contract Manufacturing Index is growth. The upwards trajectories shown within the Fabrication and Others Index are clear evidence of long-term uplifts in value, whilst it is only the Machining Index that displays any sort of stagnance. It's also important to note that the latest Index grew by 6% in relation to the comparable quarter of 2021, which shows some recuperation following the COVID-19 pandemic.

The surge in activity witnessed during March may well serve as a positive indicator for what we can expect during quarter 2. Although the materials shortage continues to blight supply chains, the latest results show that subcontract work is certainly there for the taking.

READ: Qimtek Contract Manufacturing Index - 2021 Overview

Machining:

The Machining Index grew 14% from the preceding quarter and by an impressive 36% in relation to the first quarter of 2021.

The first quarter saw a positive start to the year for the Machining Index, which reported month-on-month growth over the first three months of the year. The most pronounced jump in activity came within March, which saw its second highest levels of output in the last twelve months.This rise in outsourced machining meant that the Machining Index grew 14% from the preceding quarter and by an impressive 36% in relation to the first quarter of 2021.

The latest results are a stark contrast to what was reported in the final quarter of 2021, during which time the Machining Index underwent a 7% downturn in spite of the growth of the Fabrication and Others Indexes. The latest results flip this trend on its head, with machining making up more than half of all projects generated.

- 58% of the first quarter's projects were for machining processes.

- The buyers who gave us these projects have a total outsourcing value of £15,858,433, compared to a value of £13,923,350 in quarter 4 2021.

- This result means that the Machining Index has grown 14% from the previous quarter and 36% in relation to the first quarter of 2021.

Fabrication:

Undergoing a reduction of 15%, the Fabrication Index fell to 34% from January to March.

As the key player within the final quarter of 2021, during which time fabrication processes accounted for 57% of all projects generated, the Fabrication Index did not hold its position during the first quarter of 2022. Undergoing a reduction of 15%, this index fell to 34% from January to March - albeit with much higher activity levels towards the end of the quarter.

The total outsourcing value of the Fabrication Index also fell drastically during this time. Whereas the value for the preceding quarter was £26,753,487, the latest value plummeted to £17,486,633. Although January and February were tough months for the Fabrication Index, with low levels of outsourcing, the jump in March's results bode well for the replenishment of this index within the second quarter of 2022.

- 34% of the first quarter’s projects were for fabrication processes.

- The buyers who gave us these projects have a total outsourcing value of £17,486,633, compared to £26,753,487 during Quarter 4 2021.

- The latest results show a dramatic drop of 35% from the final quarter of 2021 and a reduction of 15% in comparison to 2021's first quarter.

Others:

There was a steep decline within the Others Index during the first quarter of 2022, with activity falling by 30%.

Representing processes such as casting, toolmaking, finishing, plastics & rubber, the ‘Others’ category makes up 8% of the projects generated within the first quarter and is therefore more difficult to monitor. It can be noted that there was a steep decline within this index during the first quarter of 2022, with activity falling by 30% in comparison to quarter 4, 2021. This tail-off can mainly be attributed to extremely low outsourcing levels during January, although February and March saw the Others Index recuperate enormously by comparison.

It's also interesting to note that despite the decline from the preceding quarter, the Others Index grew by 12% in comparison to the first quarter of 2021.

- 8% of the first quarter’s projects were for processes that fall under the ‘Others’ category.

- The buyers who gave us these projects have a total outsourcing value of £4,624,540, compared to a value of £6,625,627 in quarter 4, 2021.

- This shows a drop of 30% from the final quarter of 2021 into the first quarter of 2022; however, it's important to note that the Others Index grew 12% in comparison to the corresponding quarter last year.

Industries:

- The Industrial Machinery sector has remained in the top spot for the third quarter in a row.

- The Electronics industry has maintained its position in second place for the second consecutive quarter

- The Furniture sector has risen from fifth place into third during the first quarter of 2022, knocking Heavy Vehicles/Construction Equipment down into fourth place.

There was a lot of consistency between the top industries represented across the final quarter of 2021 and the first quarter of 2022.

There was a lot of consistency between the top industries represented across the final quarter of 2021 and the first quarter of 2022. Placing first for the third quarter in a row, the Industrial Machinery sector accounted for 30% of all projects generated from January to March, whilst the Electronics industry - with a 16% share of all projects - maintained its position in second place for the second consecutive quarter. The Furniture industry finished the first quarter in third place, having previously placed fifth during the final quarter of 2021 - this, in turn, knocked the Heavy Vehicles/Construction Equipment industry down into fourth place, accounting for 11% of all projects generated from January to March.

A newcomer to the top industries data, the Truck & Transportation sector made its debut in fifth place with 9% of all projects generated. This tied with the Communication Equipment industry, whilst Construction finished the first quarter just shy of this result, accounting for 8% of quarter 1's projects.

Having disappeared from the last quarter's results altogether, the Pump & Valve sector scraped into the top eight industries represented in quarter 1's data, accounting for 5% of the projects generated. Meanwhile, the Automotive industry (previously sixth) and the Consumer Products industry (previously seventh) did not feature in quarter 1's results.

About the Contract Manufacturing Index

The Contract Manufacturing Index (CMI) has been developed to reflect the total purchasing budget of companies that are looking to outsource manufacturing in any given month.

This reflects a sample of over 4,000 companies, who have a purchasing budget of more than £3bn and a supplier base sample of over 7,000 vendors, with a verified turnover in excess of £25bn.

We measure this by extracting data from the projects we receive from manufacturing purchasers who have an active need for the services of subcontract engineering suppliers.

Since 2016, we have published the index quarterly and this report is a summary of our findings for the first quarter of 2022. In order to shed more light on the emerging trends, we have also broken this down by process and industry.

Click here to access historic Qimtek Contract Manufacturing Index reports.